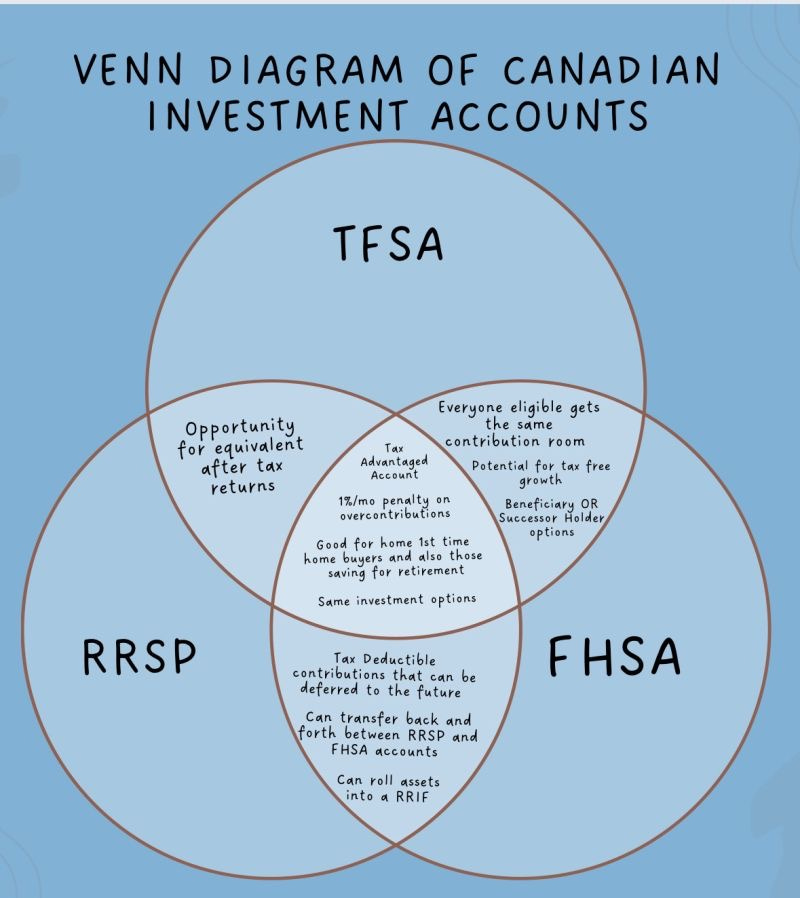

Many people assume investing means you can just spend your money and purchase stocks and that’s all you need to worry about. That is a very common mistake. It is important to understand the benefits of each of these big three accounts to identify which one makes the most sense for you. In a nutshell; all of them are great and I plan to invest in each one, however the order in which I do so is very important and closely calculated.

Let’s start by understanding the difference and the benefits of each of these accounts.

TFSA (Tax-free savings account)

A tax-free savings account is one of the most crucial, if not THE most crucial account for investors in Canada! It would be foolish to not take advantage of some of the perks that come with a TFSA. Some of the main benefits include:

Every year your contribution room increases. For example, at the start of 2025, Canadians were allowed to contribute an extra $7000 on top of their existing contribution room.

100% of your earnings or gains are tax free. This means that if you invested $20,000 and your account grows to $30,000, you do not have to pay a single penny in taxes! All of the profits are yours.

No tax on withdrawals. If you need to spend your money, you will not be penalized for any sort of withdrawals. This means you can freely use your money whenever and however you like.

Any unused contribution room from previous years gets carried into the next year.

No age restrictions, you can continue to make contributions even after the age of 71 (unlike RRSP)

A TFSA is certainly the most flexible type of investment account. However, there are a few things that you MUST be mindful of. It is important to not over-contribute to your TFSA or else you will have to pay a 1% tax on the overage every single month. You can track and view your TFSA contribution room on the CRA website.

RRSP (Registered Retirement Savings Plan)

An RRSP provides different types of benefits when compared to TFSA. Here are the main benefits:

Contributions made to your RRSP are deducted from your taxable income, which reduces your tax bill in the year of the contribution. This is a great way to ensure your tax returns are larger during your “working age”.

You can save more money for retirement without paying the taxes up front

Once you withdraw at retirement, you basically defer your taxes paid to when you are at a lower income bracket (typically when you retire)

Your investments grow tax free while in this account, but upon withdraw you still pay a (lower) tax

Dividend earnings from U.S stocks are not subject to the 15% withholding tax which is a major advantage compared to a TFSA.

As you can see, an RRSP provides exceptional benefits such as increasing your tax returns and allowing your money to grow while invested in the plan. However, since I am a long term investor, I would prioritize maximizing my TFSA first as I want to pay as little taxes as possible!

FHSA (First home savings account)

An FHSA is kind of a hybrid between a TFSA and an RRSP. Here are some of the benefits:

Contributions are tax deductible, meaning you can increase your tax returns

Any growth inside this account is tax free

Withdrawals for purchasing a home is also tax free (whereas any withdrawals in an RRSP are taxed)

Can contribute up to $8,000 per year inside this account

Can transfer funds to an RRSP seamlessly if you don’t wish to buy a house anymore

How Do I Plan On Investing Through These Accounts?

I have an RRSP account set up through my employer where a portion of my salary automatically gets invested into that account. In term’s of buying stocks through an RRSP, for me personally this would be my third option. I will still do it, but not until I maximize my contribution room inside my TFSA and FHSA first. This is because I want to capitalize as much as I can on tax free growth and not worrying about paying taxes upon withdrawal either. This is my order in terms of accounts I will invest through:

1) Maximize TFSA contribution room each year first. This is to ensure I invest as much as I legally can to reap the rewards that a TFSA offers such as tax free growth.

2) Once my TFSA is maximized, I will then maximize my FHSA. It is a huge goal of mine to purchase a house within the next few years, and the tax benefits of this account are very attractive.

3) Once my TFSA and FHSA have been fully maximized, I will buy stocks through my RRSP for the rest of the year.

I hope this posting helps you understands the benefits of the three main investing accounts in Canada! Everyone has their own goals and journey when it comes to investing their money, and my goal for the information in this article is to provide you with insight to make the best decision for yourself!